UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx Filed by Party other than Registrant¨

Check the appropriate box:

| ¨ | Preliminary proxy statement |

| ¨ | Confidential, for Use of the Commission |

| x | Definitive proxy statement |

| ¨ | Definitive additional materials |

| ¨ | Soliciting Materials pursuant to Rule 14a-11(c) or Rule 14a-12 |

FIRST ADVANTAGE CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

Dear Stockholders:

I am very pleased to invite you to attend the 20072009 annual meeting of stockholders of First Advantage Corporation, a Delaware corporation, to be held atin the Hilton St. Petersburg Carillon Park Hotel,Eagle Auditorium of our offices, located at 950 Lake Carillon Drive, St. Petersburg, Florida 33716,12395 First American Way, Poway, California 92064, on April 26, 200728, 2009 at 9:00 a.m. EasternPacific Time.

DetailsFor the first time in our company’s history, we are pleased to take advantage of the businessSecurities and Exchange Commission rule allowing companies to be conducted atfurnish proxy materials to their stockholders over the meeting are given inInternet. We believe that this e-proxy process expedites stockholders’ receipt of proxy materials, while also lowering the attached noticecosts and reducing the environmental impact of our annual meetingmeeting. On March 18, 2009, we mailed to our stockholders a Notice containing instructions on how to access our 2009 proxy statement and proxy statement.annual report online.

We hope that you are able to attend the annual meeting. It is important that you vote your shares whether or not you are able to attend in person. We urge you to read the accompanying proxy statement and to vote on the matters presentedyour shares by proxy by filling in the appropriate boxes on the enclosed proxy card and returning it promptly.promptly or by voting over the Internet or by telephone by following the instructions found on the proxy card(s). If you attend the meeting and prefer to vote in person, you may do so even if you have returnedalready voted your proxy card.shares by proxy. You may also revoke a proxy at any time before it is exercised.

Directions to the First Advantage Corporation 2009 Annual Meeting are available on the “Investor Relations” page of our website at www.fadv.com.

Thank you for your cooperation and your support and interest in First Advantage Corporation.

Anand Nallathambi

President

|

| Anand Nallathambi |

| Chief Executive Officer and President |

FIRST ADVANTAGE CORPORATION

100 Carillon Parkway12395 First American Way

St. Petersburg, FL 33716Poway, California 92064

NOTICE OF ANNUAL MEETING

To be Held on April 26, 200728, 2009

The 20072009 annual meeting of stockholders of First Advantage Corporation, a Delaware corporation, will be held atin the Hilton St. Petersburg Carillon Park Hotel,Eagle Auditorium of our offices, located at 950 Lake Carillon Drive, St. Petersburg, Florida 33716,12395 First American Way, Poway, California 92064, on April 26, 200728, 2009 at 9:00 a.m. EasternPacific Time, and at any adjournments thereof, for the following purposes:

| 1. | To elect our board of directors to serve until our |

| 2. |

| To transact such other business as may properly come before the meeting. |

Our board of directors has fixed the close of business on March 8, 200710, 2009 as the Record Date for determining the holders of our Class A and Class B common stock entitled to notice of the meeting, as well as for determining the holders of our Class A and Class B common stock entitled to vote at the meeting.

All stockholders are invited to attend the annual meeting in person. All stockholders also are respectfully urged to executevote their shares by proxy as promptly as possible by executing and returnreturning the enclosed proxy card as promptly as possible.or by voting over the internet or by telephone by following the instructions found on the proxy card(s). Stockholders who execute avote their shares by proxy card may nevertheless attend the annual meeting, revoke their proxy, and vote their shares in person. Please read the accompanying proxy statement and proxy card for information on the annual meeting and voting.instructions for voting your shares by proxy. Directions to the First Advantage Corporation 2009 Annual Meeting are available on the “Investor Relations” page of our website atwww.fadv.com.

By Order Of The Board Of Directors

Julie A. Waters

| By Order Of The Board Of Directors |

|

| Bret T. Jardine |

Vice President, Associate General Counsel and Corporate Secretary |

| March 18, 2009 |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be held April 28, 2009

The Notice of Internet Availability of Proxy Materials includes a toll-free telephone number, an e-mail address and a website where stockholders can request a paper or e-mail copy of the proxy statement, our annual report on Form 10-K for the year ended December 31, 2008 and a form of proxy relating to the annual meeting as well as information on how to access the form of proxy. If you want to receive a paper copy or an e-mail with links to the electronic materials, you must request one by contacting Bret T. Jardine, Corporate Secretary, at 100 Carillon Parkway, St. Petersburg, Florida

March 27, 2007 33716. There is no charge to you for requesting a copy.

FIRST ADVANTAGE CORPORATION

100 Carillon Parkway12395 First American Way

St. Petersburg, FL 33716Poway, California 92064

PROXY STATEMENT

for

Annual Meeting of Stockholders

April 26, 200728, 2009

The board of directors of First Advantage Corporation is soliciting proxies for use at the annual meeting of stockholders to be held atin the Hilton St. Petersburg Carillon Park Hotel,Eagle Auditorium of our offices, located at 950 Lake Carillon Drive, St. Petersburg, Florida 33716,12395 First American Way, Poway, California 92064, on April 26, 200728, 2009 at 9:00 a.m. Eastern, Pacific Time, and at any adjournments thereof. On or about March 27, 2007,

As permitted by Securities and Exchange Commission rules, we began sending the attached notice of annual meeting,are making this proxy statement the enclosed proxy card, and our annual report for 2006 (which ison Form 10-K available to our shareholders electronically via the Internet. On March 18, 2009, we mailed to our stockholders a Notice containing instructions on how to access this proxy statement and our annual report online. If you received a Notice by mail, you will not partreceive a printed copy of the proxy soliciting materials)materials in the mail. If you received a Notice by mail and would like to all holders of recordreceive a printed copy of our Class A and Class B common stock entitled to receiveproxy materials, you should follow the instructions for requesting such materials and vote.

contained in the Notice.

Frequently Asked Questions About The Annual Meeting

| Q: | What will be voted on at the annual meeting? |

| A: | The purpose of the annual meeting is to elect our directors for a one-year term |

| Q: | Does First Advantage Corporation have a recommendation on voting? |

| A: | Yes. The board of directors recommends that you vote “FOR” the nominees for director set forth in the attached proxy |

| Q: | Who is entitled to vote at the meeting? |

| A: | Holders of record of our Class A common stock and our Class B common stock at the close of business on March |

| Q: | What shares can I vote? |

| A: | You may vote all shares owned by you as of March |

| Q: | How many votes will I have? |

| A: | Holders of our Class A common stock will have one vote for each share held of record |

| Q: | What is the difference between record ownership and beneficial ownership? |

| A: | Most stockholders own their shares through a stockbroker or other nominee rather than directly in their own names. There are some differences in how to vote, depending on how you hold your shares. |

You are the record owner of shares if those shares are registered directly in your name with our transfer agent. The transfer agent for our Class A common stock is Wells Fargo Shareowner Services. We act as our own transfer agent for our Class B common stock. As the record holder of shares, you may vote such shares in person at the annual meeting or grant your voting proxy directly by completing the enclosed proxy card.

You are the beneficial owner of shares if you hold those shares in “street name” through a stockbroker, bank, trustee or other nominee, including shares held on your behalf in the First Advantage Corporation 401(k) Savings Plan. If you are a beneficial owner, these proxy

i

materials are being sent to you through your stockbroker or other nominee together with a voting instruction card. In order to vote, you must complete the voting instruction card provided by your stockbroker or other nominee to direct the record holder how to vote your shares or obtain a valid proxy from the stockbroker or other nominee who is the record owner of your shares giving you authority to vote your shares in person at the meeting. Directions to the First Advantage Corporation 2009 Annual Meeting are available on the “Investor Relations” page of our website at www.fadv.com.

i

| Q: | What is a notice of electronic availability of proxy statement and annual report? |

| A: | As permitted by Securities and Exchange Commission rules, we are making this proxy statement and our annual report available to our shareholders electronically via the Internet. On March 18, 2009, we mailed to our stockholders a Notice containing instructions on how to access this proxy statement and our annual report online. If you received a Notice by mail, you will not receive a printed copy of the proxy materials in the mail. If you received a Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials contained in the Notice. |

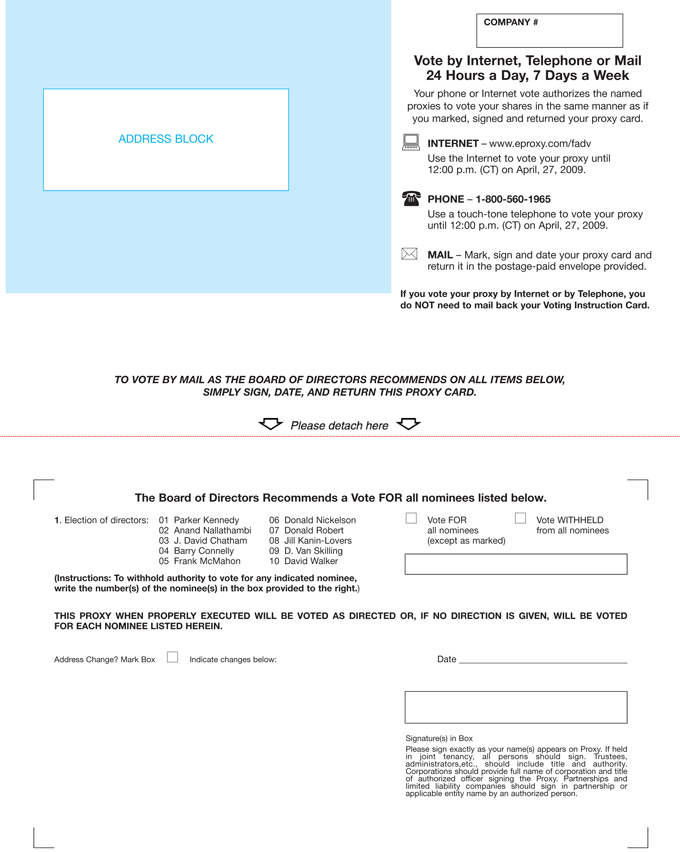

| Q: | How do I vote? |

| A: | You can vote on matters that come before the meeting in two ways: |

You can come to the annual meeting and vote in person; or

You can vote your shares by filling out, signing and returning the proxy card or voting instruction card.proxy.

If you wish to vote at the annual meeting, and you are a beneficial owner of your shares, you must have a legal proxy in your favor executed by the stockbroker or other nominee who is the record owner.

Whether or notIf you plan to attendare the annual meeting in person, please fill inrecord owner of your shares, you may vote your shares by proxy using any of the following methods:

completing, signing, dating and signreturning the enclosed proxy card in the postage-paid envelope provided;

calling the toll-free telephone number listed on the proxy card; or

using the Internet site listed on the proxy card.

The telephone and Internet voting procedures set forth on the proxy card are designed to authenticate stockholders’ identities, to allow stockholders to provide their voting instructions, and to confirm that their instructions have been properly recorded. If you vote by telephone or instruction cardover the Internet, you should not return your proxy card.

If you are a beneficial owner, you will receive voting instructions (including, if your broker, bank or other nominee elects to do so, instructions on how to vote your shares by telephone or over the Internet) from the record holder, and you must follow those instructions in order to have your shares voted at the Annual Meeting.

Depending on how you hold your shares, you may receive more than one proxy card.

Your vote is important. Whether you vote by mail, telephone or over the Internet, your shares will be voted in accordance with your instructions. If you sign, date and return it promptly.your proxy card without indicating how you want to vote your shares, the proxy holders will vote your shares in accordance with the recommendations of the Board of Directors.

| Q: | Can I revoke my proxy? |

| A: | Yes. You may revoke your proxy |

You may send in another proxy card with a later date;

You may notify Bret Jardine, our Corporate Secretary, of First Advantage Corporation, in writing before the annual meeting that you have revoked your proxy; or

You may vote in person at the annual meeting.meeting

| Q: | What is the quorum requirement? |

| A: | A quorum of stockholders is necessary to hold a valid meeting. A majority of the outstanding shares of Class A and Class B common stock on March |

Shares represented by proxies that withhold authority to vote for a nominee for election as a director or that reflect abstentions or “broker non-votes” (i.e., shares represented at the meeting held by brokers or nominees and to which (i) instructions have not been received from the beneficial owners or persons entitled to vote and (ii) the broker or nominee does not have the discretionary voting power on a particular matter (such as the proposal to amend the 2003 Incentive Compensation Plan))matter) will be treated as shares that are present for purposes of determining the presence of a quorum. Abstentions and broker non-votes will not otherwise affect the voting.

| Q: | How will my proxy be voted? |

| A: | Shares represented by |

ii

| Q: | What is the voting requirement? |

| A: | In the election of directors, you may vote “FOR” all of the nominees or your vote may be |

ii

|

For the amendment to the 2003 Incentive Compensation Plan, you may vote “FOR” or “AGAINST” the amendment to the plan. The favorable vote of the holders of a majority of the shares of common stock represented in person or by proxy at the annual meeting of stockholders and entitled to vote, a quorum being present, is required for adoption of the amendment to the plan.

| Q: | Who counts the votes cast at the annual meeting? |

| A: | Lisa Steinbach, vice president and controller of our company, acting as the inspector of election, will tabulate votes at the annual meeting. The inspector of election’s duties include determining the number of shares represented at the meeting and entitled to vote, determining the qualification of voters, conducting and accepting the votes, and, when the voting is completed, ascertaining and reporting the number of shares voted, or abstaining from voting, for the election of directors. |

iii

PROPOSAL NUMBER ONE

ELECTION OF DIRECTORS

NOMINEES FOR ELECTION OF DIRECTORS

Our charter documents require our entire board of directors to be elected annually. Our board has designated the persons listed below as candidates for election. Each is currently serving as a director, except Mr. Nallathambi.director. Unless otherwise specified in the proxy card, the proxies solicited by the board will be voted “FOR” the election of these candidates. In case any of these candidates becomes unavailable to stand for election to the board, an event that is not anticipated, the proxy holders will have full discretion and authority to vote or refrain from voting for any substitute nominee in accordance with their judgment.

The terms of directors elected at the annual meeting expire at the 20082010 annual meeting or as soon thereafter as their successors are duly elected and qualified. The board has no reason to believe that any of the nominees will be unable or unwilling to serve as a director if elected.

Directors are elected by a plurality vote of shares present at the meeting, meaning that the nominee with the most affirmative votes for a particular seat is elected for that seat. If you do not vote for a particular nominee, or if you withhold authority to vote for a particular nominee on your proxy card, your vote will not count either “for” or “against” the nominee.

John Long will cease serving as Chief Executive Officer of First Advantage on March 30, 2007 and has resigned as a member of the Board of Directors effective the same date. Our board has appointed Anand Nallathambi, currently the President of First Advantage, as Chief Executive Officer effective March 30, 2007 and as a member of the Board of Directors effective March 30, 2007, and the nominating committee has nominated Mr. Nallathambi to stand for election as a member of the Board of Directors at the annual meeting.

Lawrence Lenihan, a member of the board of directors has given notice of his intention not to stand for re-election at the annual meeting. As a result, tenTen directors will be standing for election at the annual meeting.

None of the nominees has a family relationship with the other nominees, any existing director or any executive officer of our company. Pursuant to the stockholders agreement dated as of December 13, 2002 among The First American, Corporation,FirstMark Capital, L.L.C. (formerly known as Pequot Private Equity Fund II, L.P.) and us, The First American Corporation and each of its affiliates hashave agreed to vote its shares for one nominee designated by Pequot. Mr. Lenihan was Pequot’s designated director in 2006. PequotFirstMark. However, FirstMark has not chosendesignated a designeenominee to replace Mr. Lenihan.the board of directors.

The board recommends a vote “FOR”“FOR” the election of each nominee listed below.

Parker Kennedy,S. Kennedy.Chairman and Director since 2003.2003, Mr. Kennedy, 59, was president61, has been the Chairman and Chief Executive Officer of our parent company, The First American Corporation, since 2003. He was President of The First American Corporation from 1993 until 2004, where2004. Prior to that time, he served as executive vice president from 1986 to 1993 and was appointed to its board of directors in 1987, and was named chairman and chief executive officer in 2003.1987. Mr. Kennedy has been employed by The First American Corporation’s primary subsidiary, First American Title Insurance Company, since 1977. He was appointed vice presidentVice President of that company in 1979, and in 1981 he joined its board of directors. Duringdirectors in 1981, appointed Executive Vice President in 1983, he was appointed executive vice presidentand became President in 1989. Mr. Kennedy graduated from the University of First American Title Insurance Company,Southern California with a Bachelor’s degree in economics, and in 1989 was appointed its president. He now serves as its chairman, a position to which he was appointed in 1999.received his law degree from Hastings College of the Law, San Francisco.

Anand Nallathambi,Nallathambi.Director nominee.since 2007, Mr. Nallathambi, 45, the President of First Advantage, has been47, was appointed to serve as the Chief Executive Officer of First Advantage effectivein March 30, 2007. Following2007 and President of First Advantage in September 2005 following First Advantage’s acquisition of the Credit Information Group from The First American Corporation in September 2005, Mr. Nallathambi was appointed presidentCorporation. He serves as a member of the First Advantage.Advantage acquisition committee. Prior to joining First Advantage, Mr. Nallathambi served as presidentPresident of The First American’sAmerican Corporation’s Credit Information Group and as presidentPresident of First American Appraisal Services from 1996 to 1998. Mr. NallathambiHe also serves as a member of the board of

Dorado, Inc., a privately held company. the Consumer Data Industry Association, an international trade association. Mr. Nallathambi receivedholds a masters in business administration from California Lutheran University after obtaining a bachelor of artsBachelor degree in economicsEconomics from Loyola University in Madras, India.India, and an MBA from California Lutheran University.

J. David Chatham,Chatham.Director since 2003, and is a member of our audit committee. Mr. Chatham, 56,58, also serves on the First Advantage Corporation’s audit committee and has been a director of The First American Corporation since 1989. Mr. Chatham currently serves as chairman of The First American Corporation’s1989, and chairs its audit committee and asis a member of its compensation, nominating and corporate governance committees.the executive committee. Since 1989, Mr. Chatham has also been a member of the board of directors of First American Title Insurance Company, since 1989. Since 1972, he has been presidentFirst American’s wholly-owned title insurance underwriter. He is President and chief executive officerChief Executive Officer of Chatham Holdings, Inc.,LLC, a real estate development company. Mr. Chatham graduated from the University of Georgia with a Bachelor of Business Administration degree, majoring in real estate and urban development, and completed the management of family-held corporation program at the Wharton School of Business at the University of Pennsylvania.

Barry Connelly,Connelly.Director since 2003, Mr. Connelly, 68, also serves on the First Advantage Corporation’s audit, nominating and corporate governance committees. Mr. Connelly is a member of our audit committee. Mr. Connelly, 66, servescredit information consultant to foreign governments and financial services organizations around the world. He is a director on the board of Collection House LTD, a company quotedlisted on the Australian Exchange. Mr. Connelly also serves as the chairman andExchange; a director on the board of Microbilt Corp., a privately-held credit services company; and also serves on the joint venture board of directors of Australian Business Research, LTD, a subsidiary of Collection House LTD.Huaxia/Dun & Bradstreet China. In December 2002, he retired from the Consumer Data Industry Association after 33 years of service, including eight years as president. During his tenurePresident. Mr. Connelly graduated from the University of Missouri with a Bachelor of Journalism degree.

-1-

Jill Kanin-Lovers.Director since 2006, Ms. Kanin-Lovers, 57, serves as the Consumer Data Industry Association, hechair of the First Advantage Corporation’s compensation committee and is part of its nominating and corporate governance committee. She is a member of the board of directors for BearingPoint, a global management and technology consulting firm, where she chairs the compensation committee and serves on the nominating and governing committees; Dot Foods, one of the nation’s largest food redistributors, where she chairs the compensation committee and serves on the nominating committee; and Heidrick & Struggles, a leading global search firm, where she chairs the compensation committee and serves on the audit committee. Currently, Ms. Kanin-Lovers teaches “Corporate Governance and Business Ethics” for the Rutgers University Mini-MBA program and “Executive Compensation” for the Rutgers University Global Executive HR Master’s program. Previously, she was Senior Vice President of Human Resources and Workplace Management at Avon Products, Inc., held a contributorseries of senior corporate human resources executive positions at American Express and IBM, and began her career in draftingmanagement consulting with Towers Perrin as Vice President and Manager responsible for global compensation practice. Ms. Kanin-Lovers holds a Bachelor degree from State University of New York, a Masters degree from the first Fair Credit Reporting Act in 1970University of Pennsylvania and its successor in 1997.an MBA from the Wharton School of Business at the University of Pennsylvania.

Frank McMahon,V. McMahon.Director since April 2006, and is a member of our acquisition committee. Mr. McMahon, 47,49, in addition to serving on the board of directors of First Advantage Corporation, serves as vice chairmanthe chair of its acquisition committee and chief financial officerserves on its compensation committee. He also serves as the Vice Chairman of The First American Corporation.Corporation and is Chief Executive Officer of The First American Corporation’s Information Solutions Group. Previously, Mr. McMahonhe was a managing directorManaging Director of the Investment Banking Division of Lehman Brothers, Inc. and was responsible for managing their western region financial institutions group, as well as their U.S. asset management sector from 1999 to 2006. Prior, to that, Mr. McMahon was a Managing Director at Merrill Lynch. Mr. McMahon received a Bachelor degree in Economics from Villanova University and his MBA from Duke University.

Donald Nickelson,Nickelson.Director since 2003, Mr. Nickelson, 76, in addition to serving on the board of directors of First Advantage Corporation, chairs its nominating and corporate governance committee and is a member of ourits compensation committee and acquisition committees andcommittee. Currently, he serves as chairmanVice Chairman and Director of our nominating committee. Mr. Nickelson, 74, serves as a director and vice chairman of the leveraged buy-out firm Harbour Group Industries Inc. and also sits on its executive and compensation committees. In addition, Mr. Nickelson serves, a leveraged buy-out firm; as a director of Adolor Corporation, where he servesis a member of the compensation committee and audit committee; on the audit, nominating and governance committees, and serves as a director and lead trustee of Mainstay Mutual Funds, where he serves on the nominating, performance, valuation and audit committees. Mr. Nickelson also holds directorship positions for several non-public companies, including AddressFree Corporation, Desiccare, Inc., Del Industries and the Advisory Boardadvisory board of Celtic Pharmaceutical Holdings, L.P. Prior to joining Harbour Group, he; as Chairman of the advisory board of Celtic Therapeutics; and as Chairman of Cross Match Industries. Previously, Mr. Nickelson served as presidentPresident of PaineWebber Group, an investment banking and brokerage firm, from February 1988 to January 1990.and as Lead Trustee of the Mainstay Mutual Funds Group. He has also served on numerous boards, including: as Chairman of the Pacific Stock Exchange; Omniquip International, Inc.; Greenfield Industries; Vie Financial Group; and Flair Corporation.Inc.; as director of the Chicago Board Options Exchange; W.P. Carey & Co., LLC; Royalty Pharma AG; Allied Healthcare Products; DT Industries; Selectide Corporation; and Sugen, Inc.

Donald Robert,Robert.Director since 2003, and is chairman of our compensation committee. Mr. Robert, age 47,49, in addition to serving on the board of directors of First Advantage Corporation, is currently chief executive officera member of its compensation committee. He serves as Chief Executive Officer and director of Experian Group, a globalPlc., an information technology business listed on the London Stock Exchange. Prior to his current appointment, Mr. Robert served as chief executive officerwas Chief Operating Officer and President of Experian North America and chief operating officer, and president of itsExperian’s Information Solutions business unit beginning in April 2001. From 1995 to 2001, Mr. Robertbefore becoming Chief Executive Officer of Experian North America. Previously, he was a group executiveGroup Executive of The First American Corporation with responsibility for its Consumer Information and Services Group. From 1992 to 1995, Mr. Robert was presidentGroup; President of Credco, Inc., now First Advantage Credco, the nation’s largest specialized credit reporting company and onenow part of our wholly-owned subsidiaries. He isFirst Advantage Corporation. Mr. Robert holds a director of Experian Group Limited.Bachelor degree in Business Administration from Oregon State University.

D. Van Skilling,Skilling.Director since 2005, and isMr. Skilling, 75, in addition to serving on the board of directors of First Advantage Corporation, serves as a member of ourits audit committee. Mr. Skilling 73,is the President of Skilling Enterprises. He also currently serves as Presidenta member of Skilling Enterprises and is a directorthe board of directors for several companies, including: The First American Corporation, where he is lead director and sits on the audit, nominating, corporate governance, and executive committees; Lamson & Sessions, where he chairs the compensation, nomination and governance committees; Onvia, where he is a director, and chairs the compensation committee;committee, and serves on the nominating and governance committees; and American Business Bank, where he is a member of the compensation committee. Mr. Skilling formerly servedHe retired from his post as the chairmanChairman and chief executive officerChief Executive Officer of Experian Information Solutions, Inc. (formerly TRW Information Systems & Services), following a position he was appointed26-year career with them. Mr. Skilling earned an MBA in International Business from Pepperdine University and a Bachelor degree in both Chemistry and Zoology from Colorado College.

David Walker.Director since 2003, Mr. Walker, 55, in addition to in 1996 and as a memberserving on the board of the audit and governance committees anddirectors of First Advantage Corporation, is the chair of the compensation committee of McData prior to its sale in February 2007.

David Walker, Director since 2003 and is a member of our acquisitionaudit committee and serves as chairman of our auditon the acquisition committee. Mr. Walker, 53,a Certified Public Account and a Certified Fraud Examiner, is currently the Director of the Programs of Accountancy and Social

-2-

Responsibility and Corporate Reporting in the College of Business at the University of South Florida, St. Petersburg, and is a consultant on corporate governance matters, both roles he has held since 2002. From 1975 through 2002, Mr. Walker was with Arthur Andersen LLP, serving as a partner in the firm from 1986 through 2002.matters. Mr. Walker is also a member of the boards of directors of Chicos FAS, Inc., CommVault Systems, Inc., and Technology Research Corporation, Inc., where he chairs its compensation committee,committee. Previously, he served as a partner with Arthur Andersen LLP. Mr. Walker earned a Bachelor degree from DePauw University in Economics and Chicos FAS.

Jill Kanin-Lovers, Director since October 2006Mathematics, and is a member of our compensation and nominating committees. Ms. Kanin-Lovers, 55, was a senior vice president of human resources at Avon Products, Inc.an MBA from 1998 to 2004. Before joining Avon, she was vice president, global operations, HR at IBM. Prior to IBM, she was senior vice president, worldwide compensation and benefits, at American Express. Ms. Kanin-Lovers is a member of the board of directors for Dot Foods, one of the nation’s largest food redistributors, where she chairs the compensation committee and serves on the nominating committee, and Heidrick & Struggles, a leading global search firm, where she chairs the compensation committee and serves on the audit committee. Currently, she teaches Corporate Governance for the Rutgers University Mini-MBA program.Of Chicago Graduate School Of Business.

INFORMATION ABOUT OUR BOARD OF DIRECTORS

Composition of Board and Committees

Our board of directors oversees our business and affairs and monitors the performance of management. Management is responsible for the day-to-day operations of our company. As of the date of this proxy statement, our board has ten directors and the following committees: audit, nominating and corporate governance, compensation and acquisition. The membership during the last fiscal year and the function of each of the committees are described below. Each of the committees, except the nominating and corporate governance committee, is required to be comprised of three or more members of the board.

We held sevenfive board meetings in 2006.2008. Each director attended at least 75% of all board meetings and applicable committee meetings except Mr. Robert.meetings. We strongly encourage our board of directors to attend our annual meeting of stockholders, and any member who misses three consecutive annual meetings will be removed. The following table lists membership of our board of directors and board committees:

| Committees | ||||||||||||||

Name of Director | Audit | Nominating and Corporate Governance | Compensation | Acquisition | ||||||||||

Parker Kennedy | ||||||||||||||

| X | |||||||||||||

J. David Chatham | X | |||||||||||||

Barry Connelly | X | X | ||||||||||||

| X | X | * | |||||||||||

Frank McMahon | X | X | * | |||||||||||

Donald Nickelson | X | * | X | X | ||||||||||

Donald | X | |||||||||||||

| ||||||||||||||

D. Van Skilling | X | |||||||||||||

David Walker | X | * | X | |||||||||||

X=

X = Committee Member; X*= Committee Chair

Independence Matters

Our board has determined that each of our directors is independent within the meaning of applicable NASDAQ Stock Market and Securities and Exchange Commission rules, except for ParkerMr. Kennedy, who is chairman and chief executive officer of our parent company, The First American, Corporation; John Long,Mr. Nallathambi, who is our chief executive officer through March 30, 2007; and Frankpresident, and Mr. McMahon, who is the vice chairman and chief financialexecutive officer of The First American Corporation. Mr. Nallathambi, a director nominee, will not be deemed to be independent as he currently serves as the President of First Advantage and will assume the additional role of Chief Executive Officer of First Advantage on March 30, 2007. However, we are a “controlled company” within the meaning of the NASDAQ Marketplace Rules because The First American Corporation controls more than 50% of our voting power. As such, we are relying on NASDAQ Marketplace Rule 4350(c), which allows controlled companies to be exempt from rules requiring (a) the compensation and nominating committees to be composed solely of independent directors; (b) the compensation of the executive officers to be determined by a majority of the independent directors or a compensation committee composed solely of independent directors; and (c) director nominees to be selected or recommended for the board’s selection, either by a majority of the independent directors, or a nominating committee composed solely of independent directors.American. In considering director independence, the board studied the shares of First Advantage common stock beneficially owned by each of the directors as set forth under “Security Ownership of Certain Beneficial Owners and Management,” although the board generally believes that stock ownership tends to further align a director’s interests with those of First Advantage’s other stockholders. AsIn addition, as part of this review, the board considered the fact that Mr. Robert is the chief executive officer of Experian Group, a subsidiary of which owns approximately 6.5%6.3% of our Class A common stock, and determined that this relationship does not interfere with the exercise of Mr. Robert’s independence from First Advantage and its management.

We are a “controlled company” within the meaning of the NASDAQ Marketplace Rules because First American controls more than 50% of our voting power. As such, we rely on NASDAQ Marketplace Rule 4350(c)(5), which allows controlled companies to be exempt from rules requiring (a) the compensation and nominating committees to be composed solely of independent directors; (b) the compensation of the executive officers to be determined by a majority of the independent directors or by a compensation committee composed solely of independent directors; and (c) director nominees to be selected or recommended for the board’s selection either by a majority of the independent directors or by a nominating committee composed solely of independent directors.

-3-

Our independent directors meet in executive session immediately following each regularly scheduled meeting of the board of directors. In addition, our independent directors may meet as they determine appropriate from time to time.

Audit Committee. Our board established the audit committee for the primary purposes of overseeing the accounting and financial reporting processes of our company and audits of our financial statements. Our board of directors has made an affirmative determination that each member of the audit committee (a) is an “independent director” as that term is defined by NASDAQ Marketplace Rules and the rules and regulations under the Securities Exchange Act of 1934, as amended, which we refer to as the “Exchange Act”, and (b) satisfies NASDAQ Marketplace Rules relating to financial literacy and experience. Our board of directors has further determined that DavidMessrs. Chatham and Walker satisfiessatisfy the criteria for being an “audit committee financial expert” as such term is defined in Item 407(d)(5) of Regulation S-K promulgated by the Securities and Exchange Commission.

The audit committee is solely responsible for selecting our independent registered certified public accounting firm (“independent public accounting firm;accountants”); approving in advance all audit services and related fees and terms; and approving in advance all non-audit services, if any, provided by our independent public accountants and related fees and terms. The audit committee also oversees and monitors our internal control system, evaluates the independence standards forof our independent public accountants, oversees the conduct of and personnel in our internal audit function, reviews financial information in our quarterly reports, and reviews and oversees the audit performed by our independent auditors.public accountants. The committee reports any significant developments with respect to its duties to the full board. The audit committee met 15nine times during 2006.2008. Our board of directors has adopted a written audit committee charter a(a copy of which is attached to this proxy statement as Appendix A. The audit committee charter may also be viewed on the Corporate Governance page of the Investor Relations section of our website located at www.fadv.com or a printprinted copy may be obtained by making a written request to the Bret T. Jardine, Corporate Secretary of First Advantage Corporation, at 100 Carillon Parkway, St. Petersburg, Florida 33716.33716).

Compensation Committee. The compensation committee is responsible for recommending compensation arrangements for our executive officers; evaluating the performance of our chief executive officer; and administering our compensation plans. AllExcept for Mr. McMahon, all members of the compensation committee are independent under the standards for independence established by the applicable NASDAQ Marketplace Rules. The compensation committee met sevennine times during 2006.2008. Our board of directors has adopted a written compensation committee charter a(a copy of which may be viewed on the Corporate Governance page of the Investor Relations section of our website located at www.fadv.com or a printprinted copy may be obtained by making a written request to the Bret Jardine, Corporate Secretary of First Advantage Corporation, at 100 Carillon Parkway, St. Petersburg, Florida 33716.33716). The compensation committee establishes and reviews our overall compensation philosophy. The committee reviews

the performance of our chief executive officer and has the sole authority to determine his compensation and reviews and approves the salary of our other executive officers. The committee reviews and recommends to the board for approval our incentive and equity compensation plans, oversees those who are responsible for administering those plans and approves all equity compensation plans that are not subject to stockholder approval. The compensation committee also has the authority to retain compensation consultants as it deems necessary and the sole authority to approve such consultant’s fees. When setting executive officer compensation, in the fall or in early Januaryfirst quarter of each year, Mr. Long presentedthe Chief Executive Officer presents a report to the compensation committee containing his recommendation of the upcoming year’s salary, bonus and long-term incentive award levels for certain executive officers other than himself. The committee took Mr. Long’stakes the Chief Executive Officer’s report under advisement and metmeets with its own compensation consultant. To obtain independentobjective compensation information, in 20052008 the compensation committee engaged Watson Wyatt WorldwideMercer LLC as its compensation consultant. Watson Wyatt was engaged by the compensation committee, and theThe committee has the full authority to manage all aspects of Watson Wyatt’sMercer’s engagement, including approving Watson Wyatt’sMercer’s compensation on a monthly basis and the ability, in the compensation committee’s sole discretion, to terminate the engagement. Examples of projects assigned to the consultant included the evaluation of the composition of the peer group of companies used to evaluate appropriate compensation levels, evaluation of levels of executive compensation as compared to general market compensation data and the peer companies’ compensation data, and evaluation of proposed compensation programs or changes to existing programs.

The compensation committee believes that input from both management and the consultant provide useful information and points of view to assist the compensation committee to determinein determining its own views on compensation. Although the compensation committee receives information and recommendations regarding the design of the compensation program and level of compensation for the executive officers from both the consultant and management, the compensation committee makes the final decisions as to the design and levels of compensation for these executives.

The compensation committee used Mr. Long’suses the chief executive officer’s report, and anytogether with reports that may be prepared by its consultant, to set executive officer salaries and bonuses for the upcoming year. Executive officers are not be present during compensation committee or board of directors deliberations concerning their compensation. The chairman of the board is present when setting Mr. Long’s and Mr. Nallathambi’sthe chief executive officer’s salary and bonus.

Compensation Committee Interlocks and Insider Participation.The members of the compensation committee for 20062008 were Ms. Kanin-Lovers and Messrs. Lenihan, who is not standing for re-election at the annual meeting,McMahon, Nickelson and Robert and Mmes. Sink and Kanin-Lovers. Ms. Kanin-Lovers joined the boardRobert. As noted above, Mr. McMahon is a Vice

-4-

Chairman of directors in October 2006, and Ms. Sink resigned from the board of directors in November 2006. No member of this committee was at any time during the 2006 fiscal year or at any other time an officer or employee of the company, and no member had any relationship with us requiring disclosure under Item 404 of Regulation S-K.First American, our parent company. None of our executive officers have served on the board of directors or compensation committee of any other entity that has or has had one or more executive officers who served as a member of our board of directors or our compensation committee during the 20062008 fiscal year.

Nominating and Corporate Governance Committee. Our board of directors has established a nominating and corporate governance committee to (i) assist the board in identifying individuals qualified to become directors and recommending to the board for nomination of candidates for election or reelection to the board or to fill board vacancies.vacancies, (ii) develop and recommend to our board a set of corporate governance principles and (iii) lead the board in complying with those principles. All members of the nominating committee are independent under the standards for independence established by the applicable NASDAQ Marketplace Rules. The nominating and corporate governance committee met two timestwice during 2006.2008.

The nominating and corporate governance committee acts under a written charter adopted by our board of directors (a copy of which may be viewed inon the Corporate Governance page of the Investor Relations section of our website located at www.fadv.com or a print copy may be obtained by making a written request to the Bret T. Jardine, Corporate Secretary of First Advantage Corporation, at 100 Carillon Parkway, St. Petersburg, Florida 33716.)33716) specifying, among other things, the following minimum qualifications for candidates recommended for election to the board:

impeccable character and integrity;

the ability to communicate effectively with members of the board, management, auditors and outside advisors;

a willingness to act independently;

substantial experience in business, with educational institutions, governmental entities or non-profit organizations;

the ability to read and understand financial statements and financial analysis;

the ability to analyze complex business matters;

no criminal history or a background which could reasonably be expected to damage the reputation of our company;

does not currently serve as a director, officer or employee of, or a consultant to, a direct competitor of our company; and

does not cause our company to violate independence requirements under applicable law or the NASDAQ Marketplace Rules.

The nominating committee also will consider, among other factors, whether an individual has any direct experience with our company or its subsidiaries (whether as a director, officer, employee, supplier or otherwise); the individual’s experience in the industry in which our company operates; the individual’s other obligations and time commitments; whether the individual is an employee of a company or institution on thehaving a board of directors ofon which a senior executive of our company serves; whether the individual has specific knowledge, skills or experience that may be of value to our company or a committee of the board; whether an individual has been recommended by a stockholder of our company, an independent member of the board, another member of the board, senior management of our company or a customer of our company; and the findings of any third parties that may be engaged to assist the committee in identifying directors.

The nominating and corporate governance committee regularly assesses the appropriate size of the board and whether any vacancies on the board are anticipated. Various potential candidates for director are then identified. Candidates may come to the attention of the nominating committee through current board members, professional search firms, stockholders or industry sources. In evaluating the candidate, the nominating committee will considerconsiders factors other than the candidate’s qualifications, including the current composition of the board, the balance of management and independent directors, the need for audit committee expertise and the evaluations of other prospective nominees. In connection with this evaluation, the nominating committee determines whether to interview the prospective nominee, and if warranted, one or more members of the nominating committee, and others as appropriate, interview prospective nominees. After completing this evaluation and interview, the nominating committee makes a recommendation to the full board as to the persons who should be nominated by the board, and the board determines the nominees after considering the recommendation and report of the nominating committee.

The nominating and corporate governance committee recommended the slate of directors proposed for election at the annual meeting, which was unanimously approved by the full board of directors, including unanimous approval by the independent directors. Ms. Kanin-Lovers was recommended by Mr. Nickelson who interviewed Ms. Kanin-Lovers

As part of its role in developing and recommended her tocomplying with corporate governance policies, the full nominating committee. The full nominatingand corporate governance committee then recommended toadvises the board and the various committees on effective management and leadership, reviews the governing documents of directorsthe company (including our certificate of incorporation, bylaws, corporate governance policies and guidelines and code of conduct), provides ongoing advice with respect to conflicts of interest that Ms. Kanin-Lovers be appointed tomay arise, and evaluates the board. Mr. McMahon was recommended tocurrent and future governance needs and obligations of the nominating committee by Mr. Kennedy. The full nominating committee then recommended to the board of directors that Mr. McMahon be appointed to the board.

Acquisition Committee. In December 2006,company, our board and the committees in light of directors formed an acquisition committee for the purpose of evaluating and approving potential acquisitions of other businesses. The powers of the acquisition committee were delegated to the committee by the full board of directors. The members of this committee are Messrs. Long, Walker, Nickelson and McMahon. Mr. Long has resigned from the board of directors effective as of March 30, 2007 but will continue to serve on the acquisition committee until that date. This committee has not met.“best practices” developments.

-5-

Procedure for Stockholder Nominations of Directors

Nominations for the election of directors may only be made by the board of directors in consultation with its nominating and corporate governance committee. AAs noted above, FirstMark may designate a nominee to the board of directors under the terms of the stockholders agreement dated as of December 13, 2002 among First American, FirstMark Capital and us. However, FirstMark has not designated a nominee to the board of directors. In addition, a stockholder of record who has the power to vote ten percent or more of the outstanding capital stock of our company may recommend to the nominating committee up to one candidate for consideration as a nominee in any 12-month period. The nominating committee will consider a stockholder nominee only if a stockholder gives written notice to Bret T. Jardine, Corporate Secretary of First Advantage Corporation, at 100 Carillon Parkway, St. Petersburg, Florida 33716 not later than the close of business on November 1 of the year immediately preceding the year of the annual meeting of stockholders at which the stockholder desires to have his or her candidate presented byto the board. Each such notice must include the name, address and telephone number of the potential nominee; a detailed biography of the potential nominee; and evidence of stock ownership by the presenting stockholder, including the number of shares owned. Nominees properly proposed by eligible stockholders will be evaluated by the nominating and corporate governance committee in the same manner as nominees identified by the committee. Should a stockholder recommend a candidate for director, our nominating committee would evaluate such candidate in the same way as it evaluates any other nominee. To date, no stockholder or group of stockholders owninghaving the power to vote ten percent or more than 5% of our Class A commoncapital stock for at least one year has put forth any director nominees.

Stockholder Communications

Our stockholders may communicate directly with the members of the board of directors or individual members by writing directly to it or to those individuals,them in care of Bret T. Jardine, Corporate Secretary of First Advantage Corporation, at 100 Carillon Parkway, St. Petersburg, Florida 33716, together with33716. Stockholders are required to provide appropriate evidence of their stock ownership.ownership with any communications. Communications received in writing are distributed to our board or to individual directors as appropriate depending on the facts and circumstances outlined in the communication received.

CORPORATE GOVERNANCE MATTERS

CODE OF ETHICSCONDUCT

We have adopted a code of ethicsconduct that applies to our chief executive officer, chief financial officer, controller and all of our other officers, employees and directors. Adirectors (a copy of our code of ethicswhich may be viewed on the Corporate Governance page of the Investor Relations section of our website located at www.fadv.com or a print copy may be obtained by making a written request to the Bret T. Jardine, Corporate Secretary of First Advantage Corporation, at 100 Carillon Parkway, St. Petersburg, Florida 33716.33716).

BUSINESS RELATIONSHIPS AND RELATED TRANSACTIONS

Relationships with First American

We effectively commenced operations on June 5, 2003 with our acquisition of The First American Corporation’sAmerican’s screening technology division and US SEARCH.com, Inc. As consideration for these acquisitions, we issued on or about June 5, 2003 100% of our outstanding Class B common stock to The First American Corporation and 100% of our Class A common stock to former stockholders of US SEARCH.com, Inc. Each share of our Class B common stock entitles the holder to ten votes in any meeting of stockholders. As a result, The First American Corporation received approximately 80% of the outstanding capital stock of our company and approximately 97%98% of the voting power in our company. Former stockholders of US SEARCH.com, Inc. received the remaining approximately 20% of our outstanding capital stock. Pequot Capital Management, Inc.,FirstMark, formerly a stockholder of US SEARCH.com, Inc., received approximately 10% of our Class A common stock in the transaction. The First American Corporation and Pequot Capital Management, Inc.FirstMark entered into a stockholders agreement concurrently with the acquisitions that grants Pequot Capital Management, Inc.granted FirstMark certain registration rights and the right to sell shares of our Class A common stock at the same time The First American Corporation sells any of our shares under certain circumstances, and generally requires The First American Corporation to vote for one nominee for director designated by Pequot Capital Management, Inc.

We and TheFirstMark. As a controlled subsidiary of First American, Corporationwe have various relationships with First American, which are described below.

We entered into a reimbursement agreement dated October 11, 2005 with First American whereby we reimburse The First American Corporation for the actual expenses incurred by us in connection with the participation by certain of our employees in The First American Corporation’sAmerican’s supplemental benefit plan. In 2006,2008, we reimbursed The First American Corporation $101,837$400,055 for actual and $162,090, respectively, of actual costs for John Long’s and Anand Nallathambi’s participation in the supplemental benefit plan. In addition, we reimbursed The First American Corporation interest costs of $97,804 and $146,935, respectively, related to John Long’s andfor Anand Nallathambi’s participation in the supplemental benefit plan.

On March 23, 2006, we issued an additional 1,650,455 shares of our Class B common stock to The First American Corporation under the terms of the master transfer agreement, requiring the issuance of additional shares in the event Dealertrack, a company acquired as part of the Credit Information Group, conducted an initial public offering resulting in proceeds in excess of $50,000,000. In October 2006, DealerTrack completed a follow on offering of its stock. As result of the offering, we recognized a pretax investment gain of approximately $7.0 million. The sale of the stock was at a price per share in excess of its carrying value. As a result of the issuance of the shares, our ownership interest in DealerTrack decreased from approximately 16% to 14%. We will continue to account for the investment under the equity method since we have maintained significant influence at DealerTrack.

-6-

On November 7, 2005, we entered into an operating agreement with a subsidiary of The First American Corporation that sets forth the terms under which we, along with Thethe First American Corporation subsidiary, jointly own and operate LeadClick Holding Company, LLC. We have ownership of 70% of LeadClick Holding Company LLC, with the remaining 30% being owedowned by Thethe First American Corporation subsidiary.

The First American Corporation provides certain legal, financial, technology, administrative and managerial support services to us pursuant to a service agreement that was entered into on January 1, 2004. Under the terms of the service agreement, human resources systems and payroll systems and support, network services and financial systems are provided at an annual cost of approximately $300,000. In addition, certain other services including pension and 401(k) expenses, corporate and medical insurance, personal property leasing and company car programs are provided at actual cost. The initial term of the agreement was for one year, with automatic self renewals every six months. The First American Corporation, excluding the Credit Information Group, incurred approximately $0.3 million in service fees for the years ended December 31, 2006, 2005 and 2004.

The First American Corporation and certain of its affiliates provided sales and marketing, legal, financial, technology, leased facilities, leased equipment and other administrative services to the Credit Information Group. As part of our acquisition of the Credit Information Group from The First American Corporation, we entered into an amended and restated services agreement with The First American Corporation on September 14, 2005. Under the terms of this agreement, human resources systems and payroll systems and support, network services and financial systems are provided by The First American Corporation at an annual cost of approximately $4.5 million. In addition, certain other services including pension and 401(k) expenses, corporate and medical insurance, personal property leasing and company car programs are provided at actual cost. The initial term of the agreement was for one year, with automatic self renewals every six months. We alsoFirst American incurred approximately $8.5 million in service fees for the year ended December 31, 2008.

First American and certain of its affiliates provided sales and marketing, legal, financial, technology, leased facilities, leased equipment and other administrative services to the Credit Information Group. As part of our 2005 acquisition of the Credit Information Group from First American, we entered into an amended and restated services agreement with The First American Corporation to leaseon September 14, 2005. Under the Credit Information Group’s office space in Poway, California.terms of this agreement, First American provides human resources systems and payroll systems and support, network services and financial systems at an annual cost of approximately $4.5 million. In addition, First American provides certain other services (including pension and 401(k) expenses, corporate and medical insurance, personal property leasing and company car programs) at actual cost. The lease is for an initial term of five yearsthe agreement was for one year, with a one-time option to renew the term for an additional five years. The rent payable under the lease is approximately $169,000 a month, and we are obligated to pay all costs and expenses related to the property, including operating expenses, maintenance and taxes. The Credit Information Group recognized approximately $11.6 million, $13.7 million and $11.7 million in operating expense in 2006, 2005 and 2004, respectively, relating to these services.automatic self renewals every six months. The amounts allocated to the Credit Information Group are based on management’s assumptions (primarily usage, time incurred and number of employees) as to the proportion of the services used by the Credit Information Group in relation to the actual costs incurred by The First American Corporation and its affiliates in providing the services. The company incurred approximately $4.5 million in service fees for the year ended December 31, 2008.

In 2004, we incurred $150,000 for internal audit services provided by TheWe also have an agreement with the First American Corporation.Corporation dated September 14, 2005 to lease the Credit Information Group’s office space in Poway, California. The lease has an initial term of five years with a one-time option to renew the term for an additional five years. The rent payable under the lease is approximately $169,000 per month, and we are obligated to pay all costs and expenses related to the property, including operating expenses, maintenance and taxes, which were approximately $2.0 million for the year ended December 31, 2008.

Effective January 1, 2003, we and a subsidiary of The First American Corporation entered into an agreement with a subsidiary of First American whereby we will act as an agent in selling renters insurance. We receive a commission of 12% of the insurance premiums and 20% of the profits (as defined in the agreement) of the insurance premiums written. Commissions earned in 2006, 2005 and 20042008 were approximately $0.8 million, $0.3 million and $0.1 million, respectively.$2.5 million.

We also perform employment screening, credit reporting and hiring management services for The First American Corporation.American. Total revenue from The First American Corporation werewas approximately $2.8 million, $0.7 million and $0.4$4.1 million for the yearsyear ended December 31, 2006, 2005 and 2004, respectively.2008.

First American Real Estate Solutions, LLC (“FARES”), a joint venture between First American and Experian, Information Solutions, Inc. (“Experian”), owns 50% of a joint venture that provides mortgage credit reports and operations support to a nationwide mortgage lender. In accordance with the terms of the joint venture operating agreement, the mortgage and consumer credit reporting operation of FARES receives a merge fee per credit report issued and is reimbursed for certain operating costs. In connection with the acquisition of the Credit Information Group, FARES entered into an outsourcing agreement where we continue to provide these services to the nationwide mortgage lender. These earnings totaled $5.2 million, $5.7 million and $6.7$5.3 million for the yearsyear ended December 31, 2006, 20052008. Effective January 1, 2008, the Company entered into two agreements (Computer License agreement and 2004, respectively. Totala Service Agreement) with Rels Reporting Services, LLC which replaced the original agreements that had provided for charging merge fees were $6.5 million, $7.1 millionon credit reports issued and $7.4the reimbursement of the majority of operating costs. These new agreements incorporate a transaction fee and a fixed fee for services, and minimize the reimbursement of operating costs. This management fee is included in service revenue and was $9.8 million for the yearsyear ended December 31, 2006, 2005 and 2004, respectively. Total2008. The residual reimbursement for operating costs were $6.5 million, $7.3 million, and $7.5$0.4 million for the yearsyear ended December 31, 2006, 20052008.

We, through a subsidiary, perform tax consulting services for First American pursuant to a training grants & incentives services agreement which was entered into in August 2007. We identify grants and 2004, respectively.tax credits, and match them with First American’s training curriculum and complete the necessary applications as a part of the service offering. Our fees for the training grant services are payable at twenty percent (20%) of the total amount of each approved training grant arranged by us for the benefit of First American. As of this date, there has been no significant revenue recognized under this agreement.

We, through a subsidiary, provide publicly available bankruptcy information to First American pursuant to a data license and information services agreement dated December 27, 2007. The annual fee for these services is $75,000 ($6,250 per month).

-7-

Our Lender Services segment has partnered with First American CoreLogic (“FACL”) through a series of agreements to provide major national lender consumer data from the FACL databases in a Fair Credit Reporting Act compliant method. In 2008, we purchased data from FACL for a total of $1.9 million.

We have a flood zone determination wholesale service provider agreement, dated March 1, 2008, between First American Hazard Certification LLC, a subsidiary of First American and First Advantage Credco, LLC. Under the terms of this agreement, we are permitted to resell flood products provided by First American to First Advantage Credco’s end-user customers. All product costs and pricing are market-based.

We entered into a hiring management license and service agreement, dated January 11, 2008, between a subsidiary of ours, First Advantage Enterprise Screening Corporation, and First American. Under the terms of the agreement, we will license hiring management solution software to First American and provide certain services and maintenance for the software. The fees for this agreement will be an annual fee of $305,000 (invoiced quarterly). The parties, however, have agreed to suspend performance of this agreement until such time that First American determines to proceed with its previously announced spin-off of a portion of its business.

Relationships with Experian

Experian owns approximately 6%6.3% of a combination of First Advantage’s Class A and Class B common shares and is considered a related party. The cost of credit reports purchased by us from Experian was $30.0 million, $27.4 million, and $20.0$24.9 million for the yearsyear ended December 31, 2006, 2005 and 2004, respectively.2008. We sell background and lead generation services to Experian. Total revenue from these sales was $0.2 million, $0.3 million and $0.1 million for the yearsyear ended December 31, 2006, 2005 and 2004, respectively.

On April 27, 2004, we2008. We have also entered into a promissory note with The First American Corporation. The loan evidenced by the promissory note was a $20 million uncollateralized revolving loan, with interest payable monthly. In connection with the acquisition of the Credit Information Group, this promissory note was repaid in fullregistration rights agreement in September 2005.

On July 31, 2003,2005 (and which was amended in November 2005) with Experian pursuant to which we entered into a promissory note with The First American Corporation. The loan evidenced by the promissory note was a $10 million uncollateralized revolving loan, with interest payable monthly. The principal balancehave agreed, under certain terms and conditions, to register shares of the promissory note was payable on July 31, 2006. The promissory note was subordinated to our $20 million bank debt and bore interest at the rate payable under our $20 million bank debt plus 0.5% per annum. This promissory note was repaid in full in the first quarter of 2006.Class A common stock that Experian owns.

Related Party Transaction Approval Policy.Policy

It is our policy that the audit committee review and approve in advance all related party transactions that are required to be disclosed pursuant to Item 404 of Regulation S-K promulgated by the Securities and Exchange Commission. If advance approval is not feasible, the audit committee must approve or ratify the transaction at the next scheduled meeting of the committee. Transactions required to be disclosed pursuant to Item 404 include any transaction between First Advantage and any officer, director or certain affiliates of First Advantage that has a value in excess of $120,000. In reviewing related party transactions, the audit committee evaluates all material facts about the transaction, including the nature of the transaction, the benefit provided to First Advantage, whether the transaction is on commercially reasonable terms that would have been available from an unrelated third-party and any other factors necessary to its determination that the transaction is fair to First Advantage. Our board of directors has adopted a written Statement of Policy With Respect to Related Party Transactions a(a copy of which may be viewed on the Corporate Governance page of the Investor Relations section of our website located at www.fadv.com or a printprinted copy may be obtained by making a written request to the Bret T. Jardine, Corporate Secretary of First Advantage Corporation, at 100 Carillon Parkway, St. Petersburg, Florida 33716.33716).

EXECUTIVE OFFICERS

(Listed in alphabetical order)

Our executive officers, in addition to Parker Kennedy and Anand Nallathambi are listed below:

John LongEvan Barnett, 51, chief executive officer and director61, president of our multifamily services segment since 2003. Previously, Mr. Long has resignedBarnett held senior management positions with Omni International Corporation and related entities, including positions as chief executive officerCFO and Executive Vice President. Prior to his tenure with Omni International, he was employed as a director effectivecertified public accountant with Grant Thornton LLP. Mr. Barnett served as president of March 30, 2007. Beforethe National Association of Screening Agencies from 2000 to 2003. Mr. Barnett holds agent licensure for property and casualty insurance. He graduated from The American University with a Bachelor of Science degree in accounting and a master’s degree in business administration in financial management.

Bret T. Jardine, 42, was appointed Vice President, Associate General Counsel and Corporate Secretary in October 2008 and has been with the company since 2004, acting as Corporate Secretary since 2006. Prior to joining the company, Mr. Jardine was a partner in 2003,the law firm of Zimmet, Unice, Salzman, Heyman and Jardine PA. and has been practicing law for nearly 20 years. Mr. Long was with The First American Corporation since 1990, serving first as senior vice presidentJardine received his undergraduate degree from the University of sales, then asFlorida and his law degree from Stetson University College of Law.

-8-

John Lamson, 58, chief financial officer and executive vice president and then president of First American Real Estate Tax Services, Inc. From November 1993since 2003. Prior to March 2000,joining the company, Mr. Long was president andLamson served as chief executivefinancial officer of First American Real Estate Information Services Inc., overseeinga wholly-owned subsidiary of First American, a position he held from September 1997 to June 2003. Prior to joining First American, Mr. Lamson spent over five years as a self-employed consultant. Prior to that, company’s strategic directionMr. Lamson served as chief financial officer of a financial institution and acquisitions, completing over 40 acquisitions. In March 2000,as a certified public accountant with Arthur Andersen Co. Mr. Lamson is a member of the American Institute of Certified Public Accountants and holds a Bachelor of Arts degree in business administration from the University of South Florida.

Andrew Macdonald, 45, was appointed senior vice president of corporate development in September 2007 and continues to serve as president of the First Advantage Investigative and Litigation Services segment, a position he becamehas held since January 2005. Mr. Macdonald joined the company in 2002 through the HireCheck, Inc. acquisition of Employee Health Programs, Inc. where he served as president and chief financial officer. Following the acquisition, Mr. Macdonald served as president of First Advantage Occupational Health Services Corp. and then as vice president and corporate development officer for First Advantage. He is a member of the Oxford College Board of Counselors. Mr. Macdonald received his Bachelor of Arts degree in business administration from Emory University.

Todd Mavis, 47, joined the company as executive vice president-operations on August 1, 2007. Prior to joining the company, Mr. Mavis served as president and chief executive officer of HireCheck,Danka Business Systems from April 2004 to March 2006, having joined Danka Business Systems in 2001. From 1997 to 2001, Mr. Mavis was executive vice president of Mitchell International, a leading information provider and software developer for insurance and related industries. From 1996 to 1997, Mr. Mavis was senior vice president—worldwide sales and marketing of Checkmate Electronics, Inc. where he oversaw the acquisition of Substance Abuse Management, Inc., Employee Health Programs, Inc., American Driving Records, Inc., First American Registry, Inc. and SafeRent, Inc., all of which are now part of First Advantage Corporation. Mr. Long also serves on the board of directors of First American Title Insurance Company, a wholly-owned subsidiary of The First American Corporation. He has resigned as a director effective as of March 30, 2007. Mr. Long earnedMavis holds a Bachelor of Arts degree in marketing and administration from the CollegeUniversity of New RochelleOklahoma and a Mastersmasters degree in business administration from Hofstra University in New York.San Diego State University.

Akshaya Mehta, 47,49, has been the executive vice president-corporate infrastructure since August 2007. From 2003 to August 2007, Mr. Mehta served the company as chief operating officer and executive vice president since 2003.president. Previously, Mr. Mehta served as executive vice president and chief operating officer of American Driving Records, Inc., a wholly-owned subsidiary of ours. Mr. Mehta has over 15 years of management experience and over 20 years of technology development expertise. Prior to joining American Driving Records, Inc. in 1999, Mr. Mehta served as division vice president of product development at Automatic Data Processing, Inc., vice president of development at Security Pacific Bank, and Deputy Head of Development at UBS London. Mr. Mehta earned a masters degree in computer science at the Imperial College of the University of London after obtaining a bachelorBachelor of scienceScience degree in physics and medical physics from Queen Elizabeth College of the same university.University of London.

John LamsonThomas Milligan, 56, chief53, was appointed Vice President and Corporate Treasurer in 2003. He previously served as Treasurer of First American Real Estate Information Services, Inc. which he joined in January 1998. Among other duties, Mr. Milligan manages the corporate treasury function, and other financial officermanagement, planning and executive vice president sincerelated analysis for the company. Prior to 1998, Mr. Milligan was Director of Finance for IMC Mortgage Company. Before joining IMC, he provided acquisition financing with Household Commercial Finance and worked in the Chicago office of Deloitte & Touche. Mr. Milligan received his undergraduate business degree from the University of Florida and an MBA from Keller Graduate School of Management. He is also a Certified Public Accountant.

Lisa Steinbach, 45, was appointed Vice President and Corporate Controller in 2003. Prior to joining the company, Mr. Lamson served as chief financial officerMs. Steinbach was Controller of First American Real Estate Information Services Inc., a wholly-owned subsidiaryposition she held since joining the company in 1997. Other prior experience includes over 12 years of The First American Corporation, a position he held from September 1997 to June 2003. Prior to that, Mr. Lamson served as chief financial officerincreasing responsibility with certified public accountants Cherry Bekaert and Holland, Alfa Romeo Distributors of a financial institutionNorth America, and asEckerd Corporation. Ms. Steinbach is a certified public accountant with Arthur Andersen & Co. Mr. Lamson is a member of the American Institute of Certified Public Accountantsin Florida and holds a bachelor of arts degree in business administration from the University of South Florida.

Julie Waters, 40, vice president and general counsel since 2004. Prior to joining the company, Ms. Waters was general counsel for USA Floral Products, Inc., formally a publicly traded company listed on NASDAQ. Ms. Waters was previously employed as in-house counsel for Teco Corporation and Spalding & Evenflo Corporation. Ms. Waters received her juris doctorate from George Washington University after receiving a bachelor of arts degree in English and Rhetoric & Communications from the University of Virginia.

Alan Missen, 44, chief information officer since March 2005. Prior to joining the company, Mr. Missen was with PricewaterhouseCoopers LLP, first as director of shared services applications and most recently as director of portfolio management. Before joining PricewaterhouseCoopers LLP, Mr. Missen was a senior information technology manager with Arthur Andersen LLP. Mr. Missen has more than 20 years of experience in information technology. Mr. Missen holds a bachelor of science degree in statistics from the University of Toronto.

Evan Barnett, 59, president of our multifamily services segment since 2003. Previously, Mr. Barnett held senior management positions with Omni International Corporation and related entities, including positions as CFO and Executive Vice President. Prior to his tenure with Omni International, he was employed as a certified public accountant with Grant Thornton LLP. Mr. Barnett served as president of the National Association of Screening Agencies from 2000 to 2003. Mr. Barnett holds agent licensure for property and casualty insurance. He graduated from The American University with a bachelor of science degree in accounting and a master’s degree in business administration in financial management.